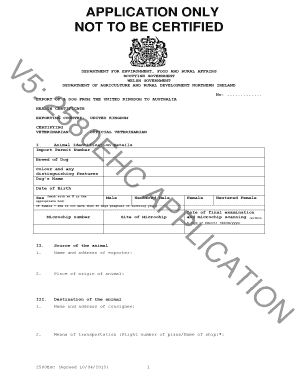

Get the free tr 63

Show details

State My Commission Expires day of Notary Seal LIEN HOLDER S CONSENT TO ELIMINATE TITLE I the undersigned authorized official of the lien holder listed herein consent to the elimination of the title for the manufactured/mobile home described herein. Authorized Official s Signature Date Position Title APPROVED APPLICATION TO BE FORWARDED TO DO NOT WRITE BELOW THIS LINE - For Division of Vehicles and Recorder of Deeds Use Only APPLICATION APPROVED BY TITLES AND REGISTRATIONS BUREAU FOR RECORDER...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tr 63 form

Edit your tr 63 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tr 63 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tr 63 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tr 63 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tr 63 form

How to fill out tr 63 kansas?

01

Obtain the TR 63 Kansas form from the appropriate government agency or website.

02

Carefully read through the instructions provided with the form to ensure that you understand the requirements and any supporting documentation that may be needed.

03

Fill in your personal information accurately and completely. This may include your name, address, social security number, and other relevant details.

04

Provide any additional information or documentation that is necessary for the completion of the form. This may include income statements, tax returns, or other supporting materials.

05

Review the completed form to ensure that all information is correct and that there are no errors or omissions.

06

Sign and date the form before submitting it to the relevant government agency or department.

Who needs tr 63 kansas?

01

Individuals who reside in the state of Kansas and need to report specific information or complete certain transactions with the government.

02

Employers or businesses who are required to report employee wages or withholdings to the state.

03

Taxpayers who are seeking to claim certain deductions or exemptions on their Kansas state tax returns.

04

Anyone who is engaged in activities that require them to register or obtain permits or licenses from the state of Kansas.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a title after a lien release in Kansas?

Your Kansas title will be mailed to you if there is not a lien against the vehicle. Please allow 4 to 6 weeks for delivery. If there is a lien, the title will not be printed until the lien is paid off and a lien release has been submitted with the State of Kansas.

Can I buy a car without a title in Kansas?

If you buy a car and do not get title at the time of the sale, or if agreed within 60 days of the sale, the sale is void and untrue, per KSA 8-135. You can cancel the sale and get your money back, if you can find the seller.

How do I get a title after paying off my loan in Kansas?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How do I get a title after a lien is released in Kansas?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How do I file for a lost title in Kansas?

Lost Titles If you lost a title that did not have a lien listed on the face of the document, you must fill out an application for a duplicate title (TR-720B) and bring it, along with a copy of current vehicle registration, to any one of the tag offices.

How do I get a title for a trailer in Kansas?

A vehicle or trailer along with the title or bill of sale must be taken to a Kansas motor vehicle inspection station and after the inspection, be issued an MVE-1 receipt. The pink copy of the MVE-1 is to be surrendered to the county treasurer's motor vehicle office when you make application for title and registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tr 63 form for eSignature?

Once your tr 63 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the tr 63 form electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tr 63 form and you'll be done in minutes.

How can I fill out tr 63 form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your tr 63 form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is tr 63 kansas?

TR-63 is a tax form used in Kansas for reporting sales and compensating use taxes.

Who is required to file tr 63 kansas?

Businesses and individuals who collect sales tax or are subject to sales tax must file TR-63 in Kansas.

How to fill out tr 63 kansas?

To fill out TR-63, provide your business information, report total sales, calculate tax due, and sign the form before submitting it to the Kansas Department of Revenue.

What is the purpose of tr 63 kansas?

The purpose of TR-63 is to report and remit sales tax collected by businesses to the state of Kansas.

What information must be reported on tr 63 kansas?

TR-63 requires reporting on total sales, tax collected, any exemptions, and the amount due for remittance.

Fill out your tr 63 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tr 63 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.