Get the free tr63 affidavit from state of kansas

Show details

State My Commission Expires day of Notary Seal LIEN HOLDER S CONSENT TO ELIMINATE TITLE I the undersigned authorized official of the lien holder listed herein consent to the elimination of the title for the manufactured/mobile home described herein. Authorized Official s Signature Date Position Title APPROVED APPLICATION TO BE FORWARDED TO DO NOT WRITE BELOW THIS LINE - For Division of Vehicles and Recorder of Deeds Use Only APPLICATION APPROVED BY TITLES AND REGISTRATIONS BUREAU FOR RECORDER...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state of kansas tr 63 form

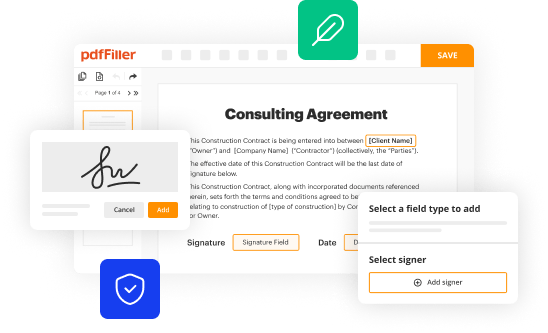

Edit your tr 63 kansas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

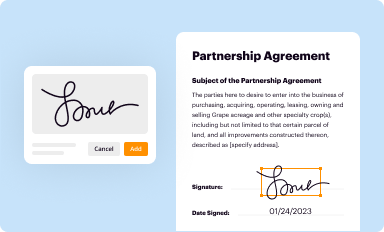

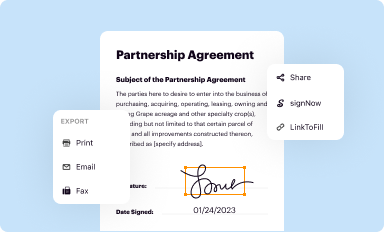

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas tr 63 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas tr63 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tr 63 state of kansa form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tr 63 in kansas form

How to fill out tr 63 kansas?

01

Obtain the TR 63 Kansas form from the appropriate government agency or website.

02

Carefully read through the instructions provided with the form to ensure that you understand the requirements and any supporting documentation that may be needed.

03

Fill in your personal information accurately and completely. This may include your name, address, social security number, and other relevant details.

04

Provide any additional information or documentation that is necessary for the completion of the form. This may include income statements, tax returns, or other supporting materials.

05

Review the completed form to ensure that all information is correct and that there are no errors or omissions.

06

Sign and date the form before submitting it to the relevant government agency or department.

Who needs tr 63 kansas?

01

Individuals who reside in the state of Kansas and need to report specific information or complete certain transactions with the government.

02

Employers or businesses who are required to report employee wages or withholdings to the state.

03

Taxpayers who are seeking to claim certain deductions or exemptions on their Kansas state tax returns.

04

Anyone who is engaged in activities that require them to register or obtain permits or licenses from the state of Kansas.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a title after a lien release in Kansas?

Your Kansas title will be mailed to you if there is not a lien against the vehicle. Please allow 4 to 6 weeks for delivery. If there is a lien, the title will not be printed until the lien is paid off and a lien release has been submitted with the State of Kansas.

Can I buy a car without a title in Kansas?

If you buy a car and do not get title at the time of the sale, or if agreed within 60 days of the sale, the sale is void and untrue, per KSA 8-135. You can cancel the sale and get your money back, if you can find the seller.

How do I get a title after paying off my loan in Kansas?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How do I get a title after a lien is released in Kansas?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How do I file for a lost title in Kansas?

Lost Titles If you lost a title that did not have a lien listed on the face of the document, you must fill out an application for a duplicate title (TR-720B) and bring it, along with a copy of current vehicle registration, to any one of the tag offices.

How do I get a title for a trailer in Kansas?

A vehicle or trailer along with the title or bill of sale must be taken to a Kansas motor vehicle inspection station and after the inspection, be issued an MVE-1 receipt. The pink copy of the MVE-1 is to be surrendered to the county treasurer's motor vehicle office when you make application for title and registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tr 63 kansas?

There is no specific information available about tr 63 Kansas.

Who is required to file tr 63 kansas?

TR-63 in Kansas refers to the Kansas Retailers' Sales Tax Compensating Use Tax and Retailers’ Compensating Use Tax Report filing. This report should be filed by retailers and businesses with a physical presence in Kansas that make sales or deliver taxable products or services in the state, and are required to collect and remit sales tax to the Kansas Department of Revenue.

What is the purpose of tr 63 kansas?

TR-63 Kansas refers to Technical Report 63, a document published by the Kansas Geological Survey. The purpose of TR-63 Kansas is to provide geological and geophysical data and analysis for the state of Kansas. It contains detailed information about the state's rock formations, stratigraphy, mineral resources, and other relevant geological aspects. This report serves as a valuable resource for researchers, geologists, policymakers, and industries looking to understand and utilize Kansas' geological resources.

What information must be reported on tr 63 kansas?

TR-63 is a Kansas Department of Revenue form used for reporting sales and use tax. The specific information that must be reported on TR-63 includes:

1. Reporting period: Enter the applicable reporting period for the sales and use tax collected. This can be monthly, quarterly, or annually.

2. Business name and address: Provide the legal business name, address, and the Kansas Taxpayer ID of the reporting entity.

3. Total sales subject to tax: Report the total amount of sales subject to Kansas sales tax during the reporting period. This includes the sales amount for both taxable and exempt goods or services.

4. Kansas gross receipts: Provide the total gross receipts from all sources (including taxable, exempt, and out-of-state sales or services) during the reporting period.

5. Gross receipts subject to tax: Report the total amount of gross receipts subject to Kansas sales tax during the reporting period. This excludes any exempt sales or services.

6. Taxable sales: Provide the total amount of taxable sales subject to Kansas sales tax during the reporting period.

7. Sales tax collected: Report the amount of sales tax collected on taxable sales during the reporting period.

8. Tax due: Calculate and report the total sales tax due by multiplying the sales tax rate by the taxable sales.

9. Exempt sales: If applicable, provide the total amount of exempt sales or services made during the reporting period.

10. Out-of-state sales: If applicable, report the total amount of gross receipts from out-of-state sales or services during the reporting period.

11. Other information: Include any additional details or explanations as required.

It is important to consult the Kansas Department of Revenue's official instructions for TR-63 or seek professional advice to ensure accurate and compliant reporting.

How can I send tr63 affidavit from state for eSignature?

Once your tr63 affidavit from state is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the tr63 affidavit from state electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tr63 affidavit from state and you'll be done in minutes.

How can I fill out tr63 affidavit from state on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your tr63 affidavit from state from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your tr63 affidavit from state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

tr63 Affidavit From State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.